Table of Content

This means that if you are renting land or do not own the property outright, you will not be eligible for this type of loan. Both funds aim to increase the supply of affordable housing of all tenures in rural Scotland and contribute to our 50,000 affordable homes target. FHA loan limits vary, depending on the area in which you plan to buy your home. Go to the search page for FHA Mortgage Limits, and use the pull-down menu to select the state. The next page that comes up will show the limits available for FHA insured loans, based on the type of property — single-family up to four-family dwelling.

Generally speaking, Rural Development defines a rural area as a city, or community of residence USDA has set household income limits that need to be checked to determine eligibility. To view a detailed list of each state with county limits visit our USDA Home Loan information by state page. USDA Home Loans are intended for families interested in purchasing single family, stick built homes. Investment properties, homes that are considered income producing properties, and mobile homes are not eligible for USDA financing. A USDA loan is a perfect loan for a home that is considered ‘move in ready’ and not in need of major repairs.

Loan Terms

However if any of these homes need work they likely won’t qualify to purchase using this program. Each program provides cost share assistance, through participating States, to organic producers and/or organic handlers. Recipients must receive initial certification or continuation of certification from a USDA accredited certifying agent . The streamline-assist refinance doesn’t require a credit check, appraisal, or proof of your income. You must, however, save at least $50 on your monthly payment to qualify. Technically, the USDA doesn’t have a maximum loan amount like the FHA sets.

At North Avenue Capital, we have assisted many business owners apply and close USDA-backed USDA Business and Industry Loans that helped them achieve their dreams and goals. We understand how these loans benefit employers and employees, who are living in rural areas and want to make a difference in their communities. We have offices in Northeast Florida, Nevada, Arkansas, Georgia, Tennessee and Texas, and are able to partner with lenders in all 50 states and US territories. Get in touch with us today to learn more about how we can help you with qualifying for a USDA B& I Loan. USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

© 2022 All rights reserved. Bayou Morgtage LLC DBA Bayou Mortgage. Bayou Mortgage is an Equal Opportunity Lender. NMLS #1845349

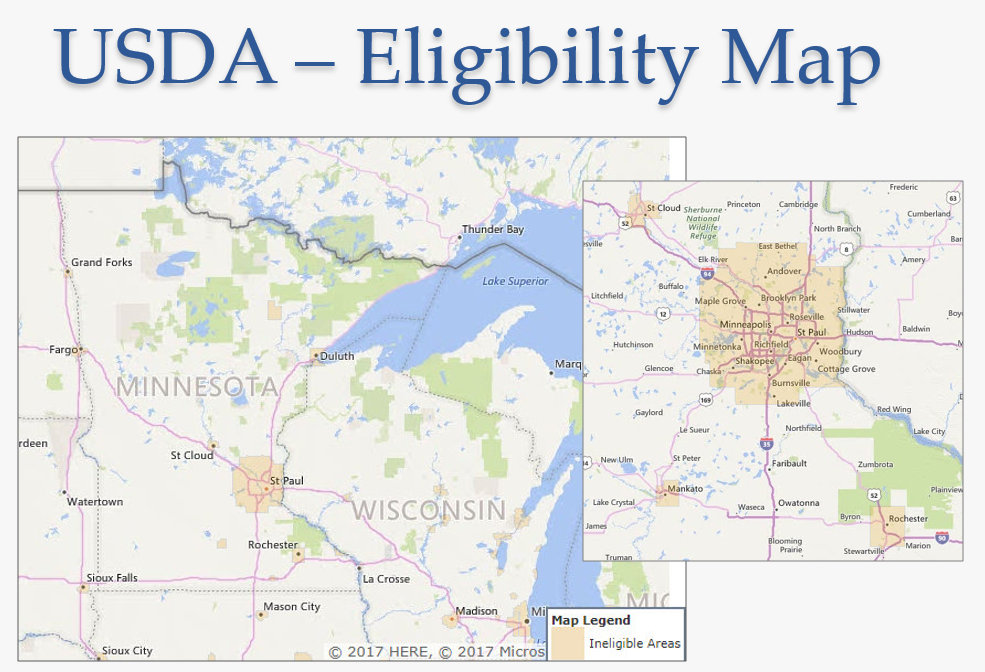

Utilizing the USDA Eligibility Site you can enter a specific address for determination or just search the map to review general eligible areas. Start-up venture costs, including, but not limited to, financing fixed assets such as real estate, buildings, equipment, or working capital. Up to 10 percent of grant funds may be applied toward operating expenses over the life of the Revolving Loan Fund.

Another great benefit of USDA Rural Development Home Loans is that they offer flexible repayment options. You can choose to repay your loan over a period of 30 years, or you can opt for a shorter repayment term of 15 years. This flexibility makes USDA loans an attractive option for many borrowers. You can lock in a lower interest rate with a USDA loan than a conventional loan, especially if you have a good to excellent credit score. This could save you tens of thousands of dollars in interest over the lifetime of the loan.

Usda Loans: What They Are And Who’s Eligible

Please review the Must Have section for the items you will need before you are ready to register or apply. Fixed interest rates on USDA loans are based on current market rates, which, as of February 2021, are 2.62%, with an average percentage rate of 2.803%. You pay them all back the same way, in monthly payments with interest. But USDA loans, like other government-backed loans, are different in a few ways.

Contact a local USDA office to learn more about these loans and how to apply for one. The USDA Rural Development Home Loan program is administered by the US Department of Agriculture Rural Development office. The program is available in all 50 states, Puerto Rico, and the US Virgin Islands. Interested applicants must contact their local USDA RD office to determine eligibility and apply for the loan.

You Must Have Level 2 eAuthentication ID - What is it?

Borrowers can receive up to 102% financing of the purchase price, which can help with closing costs. And no private mortgage insurance requirement for qualified applicants. Using the Single Family Housing Direct Self- Assessment tool, potential applicants may enter information online to determine if the Section 502 Direct Loan Program is a good fit for them prior to applying. Potential applicants are welcome to submit a complete application for an official determination by USDA Rural Development regardless of the self-assessment results.

To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. If you are interested in applying for a guaranteed loan, or have more specific questions not answered by the website, please reach out to any of the program‘s approved lenders for further assistance.

USDA loans are available to families with low incomes and can help them get into a more affordable home. There are a few key differences between the USDA Rural Development Home Loan and farm owner loans. For one, farm owner loans are only available to farmers who own their own land.

This means that there is no down payment required when using your USDA Loan. While the loan does have a $0 down payment requirement, it is important to remember that there are still closing costs. However below I will show you how to get the seller to cover everything but your appraisal. To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. Like any other refinance, you must get an appraisal, go through a credit check, and prove that you can afford the loan. If there’s room in the loan, though, you can wrap your closing costs into the loan.

As you’ll see below, you don’t need great credit or any other crazy qualifying factors to secure USDA financing. The program makes it easy for first-time homebuyers and those that don’t qualify for any other financing options to buy a home. The USDA Rural Development Home Loan program offers several benefits to eligible borrowers, including low interest rates, no down payment requirements, and flexible terms. The loan is insured by the US government, which protects the lender in the event of borrower default. Additionally, the USDA RD Home Loan program offers several financing options that can be tailored to meet the needs of each borrower. A credit score of 550 tells banks you are a high-risk borrower, but it does not necessarily render you untouchable.

The value of a home financed with a direct loan may not exceed the area limit. Assistance is available in the States, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of Northern Mariana's, and the Trust Territories of the Pacific Islands. Direct loans are made at the interest rate specified in RD Instruction 440.1, Exhibit B . Department of Agriculture introduced the Single Family Housing Guaranteed Loan Program to boost homeownership in rural America.

You must not be suspended or debarred from participation in federal programs. After your submitted information is accepted, you will be sent an activation email. You will receive a second email requesting you to verify your Level 2 access. You can either 1) use the Online Self-Service or 2) Visit a Local Registration Authority to verify your identity.

In order to qualify for this benefit program, your property must be located in an eligible rural area. Very low-income is defined as below 50 percent of the area median income ; low-income is between 50 and 80 percent of AMI; moderate income is below 115 percent of AMI. Families must be without adequate housing, but able to afford the housing payments, including principal, interest, taxes, and insurance .

No comments:

Post a Comment