Table of Content

If your credit score exceeds 620, the lender does not have to evaluate your loan file as closely. This means you do not have to verify your housing history or prove that any old debts are paid off. In addition, if you have any special circumstances on your loan, such as a high debt ratio or you have a short job history, you may be able to secure a waiver and still obtain the loan. Your credit score speaks volumes to lenders as it lets them know how financially responsible you are, so it pays to make your debt payments on time.

You must prove that you made good on the debt before you can get USDA financing. In addition, you must be able to prove that you don’t qualify for any other financing, such as FHA or conventional loans. In particular, families with 1-4 family members can have a household income of up to $86,700.

The Difference Between the USDA Rural Development Home Loan and Farm Owner Loans

CNA Template - The CNA Template Ver 1.5h should be used in lieu of all previously used versions of CNA Worksheets. The template documents the findings reached when using RD's Addendum the Capital Needs Assessment process. It includes updated estimated useful life tables and incorporates the rehabilitation guidance and miscellaneous format revisions for consistency with current program initiatives. This form has been tested and verified using the standard Windows Microsoft Excel ® to resolve compatibility issues previously reported.

In general, they will need to see some type of housing history with timely payments as well as other debts that you managed responsibly. Dont worry if you dont have a mortgage right now, if you rent, your landlord can provide you with a Verification of Rent. This document states how many times you made your rent payments on time and how long you have paid rent to the landlord. Farm Loan Center provides lending options farms and agricultural properties in all 50 states.

What Is A Usda Loan

The applicable very low-income limitfor the area if you have a Section 504 home repair loan. If you have an account with us and you would like to view your mortgage account information, you must first obtain a USDA level 1 Customer ID and Password, which you can do by registering below. To apply for Direct loans obtain Application Form (RD 410-4) and Release Form (RD ).

Qualifying for the USDA Rural Development Loan is easier than qualifying for most other loans. However, you have to meet one strict requirement you cannot be eligible for any other type of financing. If you are able to secure a different type of financing, you would not be eligible for a USDA loan.

How To Qualify For A Usda Loan

The Online Self-Service will verify your identity on-line by programmatically asking and receiving correct answers to a series of multiple choice questions that only you should know the answers to. If a conventional lender has turned you down because of your income, a USDA loan might be the right option towards homeownership. Whether you’re moving to the suburbs or the country, this federal mortgage program could save you thousands. Applications for this program are accepted through your local RD office year round. Rural Development undertakes these programs to promote rural economic development and job creation projects. Please select your state in the dropdown menu above to find your local contact for this program.

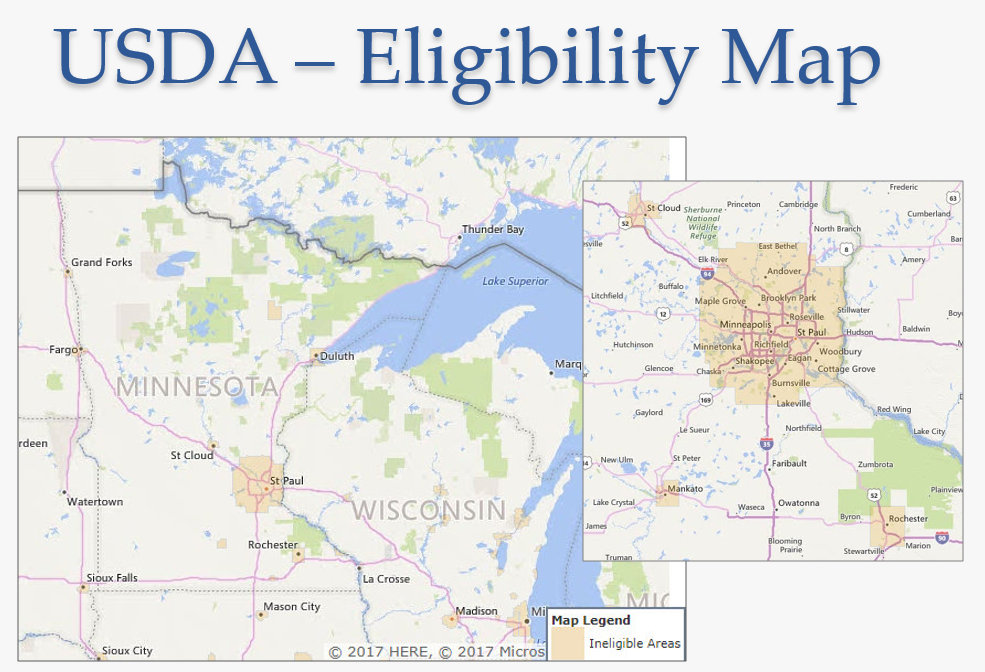

In order to qualify for this benefit program, your property must be located in an eligible rural area. Very low-income is defined as below 50 percent of the area median income ; low-income is between 50 and 80 percent of AMI; moderate income is below 115 percent of AMI. Families must be without adequate housing, but able to afford the housing payments, including principal, interest, taxes, and insurance .

Pros and Cons of USDA Loans

Rural Development allows the seller to cover up to 6% of the purchase price in closing costs. This means if you purchased a $200,000 home and received the full 6% the seller could contribute up to $12,000 towards the buyers costs. (Which would be well above what was needed to cover 100% of the costs). The even better news is that it’s fairly common to have the seller contribute between $5,000 to $8,000.

Chapter 13 Bankruptcy – You may apply for a USDA loan just one year after filing for Chapter 13 bankruptcy. You’ll probably need the approval of your trustee in order to take on the new debt, though. The USDA appraiser’s job is to make sure the home is safe and livable. If it doesn’t meet the USDA requirements, the seller must fix the issues before the loan can close.

The value of a home financed with a direct loan may not exceed the area limit. Assistance is available in the States, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of Northern Mariana's, and the Trust Territories of the Pacific Islands. Direct loans are made at the interest rate specified in RD Instruction 440.1, Exhibit B . Department of Agriculture introduced the Single Family Housing Guaranteed Loan Program to boost homeownership in rural America.

The USDA has requirements homebuyers must meet in order to qualify for the loan program. These requirements are designed to ensure that potential borrowers are willing and able to repay the loan. This program is only offered directly through the USDA Rural Development and you must visit one of their local offices in order to get an application. Only homebuyers who are under the lowest income for their areas will qualify.

USDA Loans are unique in that they are the only loan program that allows you to finance the closing costs into the loan IF the home appraises for more than you purchased it for. The USDA does not have any published restrictions on credit scores but most lenders set a score requirement for each borrower. In order to obtain an automated approval for USDA Loans you must have a credit score of at least a 640. However if your score is lower than this it doesn’t mean you can’t qualify. While most lender will stick to this 640 requirement we have multiple lenders that will allow us to help clients with credit scores as low as 580 using a manual underwrite. The USDA Rural Development Loan in Louisiana allows home buyers to purchase a home with no down payment required.

The goal of the USDA Rural Development Loan is to build home ownership in less population dense communities. USDA loans are great programs for anyone looking to purchase a home in suburban and more rural areas. Basically anything typically located outside of major city limits will qualify. The other factor to determine eligibility would be the location of the home. USDA Home Loans are available to people who live in rural and suburban communities.

How Do Usda Loans Compare To Conventional Loans

This list of active lendersis searchable by state and every effort is made by the SFHGLP team to keep this up to date. USDA Section 502 Guaranteed Loans are offered at a 30year fixed rate only. This list ofactive lenders is searchable by state and every effort is made by the SFHGLP team to keep this up to date.

No comments:

Post a Comment